For several decades, Canadian families have received financial assistance from the federal government to help offset the cost of raising children, through a range of benefits and allowance programs. Those programs have taken a variety of forms, from direct payments to parents to credits provided on the annual tax return. Some amounts provided under some such programs were taxable, while others were not. The one constant throughout those decades is that such programs are in a continual state of change and revision, resulting in a sometimes confusing patchwork of entitlements.

A New Benefits Payment System for Canadian Families

[fa icon="calendar'] Apr 21, 2016 9:30:00 AM / by Allen Koroll posted in CRA

Upcoming Changes to Financing a Post-Secondary Education

[fa icon="calendar'] Apr 12, 2016 3:00:00 PM / by Allen Koroll posted in Education

Over the next academic and calendar year, post-secondary students will find that a number of changes are taking place with respect to the rules governing the financing side of post-secondary education. Some of those changes will be welcome, and others will not.

Registered Disability Savings Plans (RDSP)

[fa icon="calendar'] Apr 7, 2016 2:30:00 PM / by Allen Koroll posted in CRA

Having a disability or caring for an individual with a disability can be emotionally and financially draining. The Canadian government, recognizing the need to assist in the future care of an individual with a disability, has created a vehicle for persons with disabilities and their families to save for the future.

Last-minute Tax Filing Strategies

[fa icon="calendar'] Apr 6, 2016 10:00:00 AM / by Allen Koroll posted in CRA

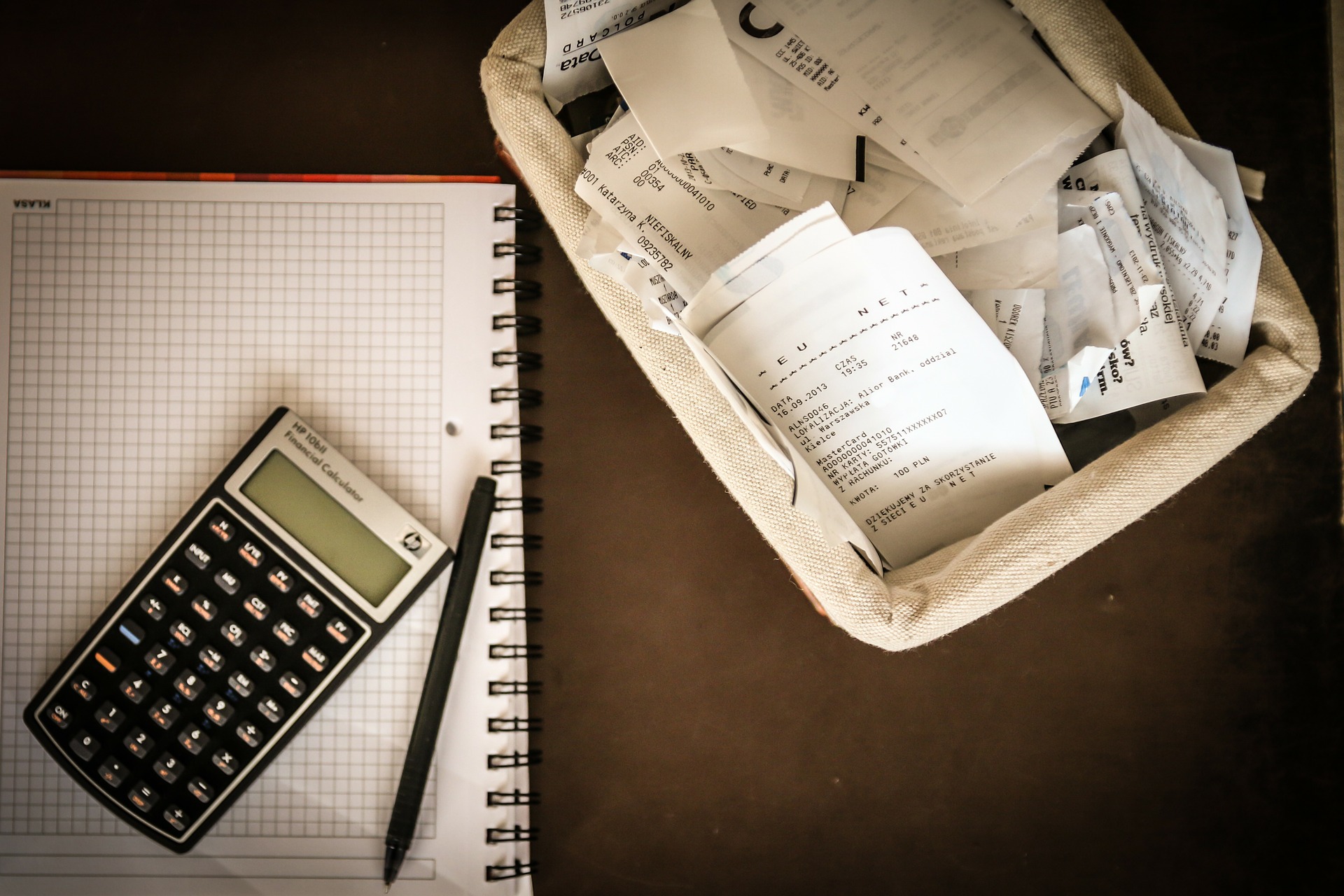

By the time most Canadians sit down to organize their various tax slips and receipts and undertake to complete their tax return for 2015, the most significant opportunities to minimize the tax bill for the year are no longer available. Most such tax planning or saving strategies, in order to be effective for 2015, must have been implemented by the end of the calendar year. The major exception to that is, of course, the making of registered retirement savings plan (RRSP) contributions, but even that had to be done on or before February 29, 2016 in order to be deducted on the return for 2015.

Dealing With The CRA Through A Representative

[fa icon="calendar'] Mar 24, 2016 1:00:00 PM / by Allen Koroll posted in CRA, Small Business

There’s no denying that the Canadian tax system is complex, even for individuals with relatively straightforward tax and financial circumstances. As well, significant costs can follow if a taxpayer gets it wrong when filing the annual tax return. Sometimes those costs are measured in the amount of time needed to straighten out the consequences of mistakes made on the annual return; in a worst case scenario, they can involve financial costs in the form of interest charges or even penalties levied for a failure to remit taxes payable on time or in the right amount.

Canada Federal Budget Commentary

[fa icon="calendar'] Mar 23, 2016 2:30:00 PM / by Allen Koroll posted in CRA

Budget Highlighting Economic growth, Job creation, and Strong middle class

When the new government said last year that it would return Canada to deficits, few expected the numbers to jump to nearly $30 billion this year and next and add $100 billion in debt over the next five years. But lower-than-expected revenues have forced the government’s hand, according to Finance Minister Bill Morneau, requiring increased spending to stimulate the sluggish economy and support the middle class.

Pension Income Splitting - Getting Something For Nothing

[fa icon="calendar'] Mar 18, 2016 3:08:00 PM / by Allen Koroll posted in Pension Plans

Any taxpayer told of a strategy that offered the possibility of saving hundreds or thousands of dollars in tax and increasing his or her eligibility for government benefits while requiring no advance planning, no expenditure of funds, and almost no expenditure of time could be forgiven for thinking that what was proposed was an illegal tax scam. In fact, that description applies to pension income splitting which is a government-sanctioned strategy to allow married taxpayers over the age of 65 (or, in some cases, age 60) to minimize their combined tax bill by dividing their private pension income in a way which creates the best possible tax result.

When And How To File Your Tax Return For 2015

[fa icon="calendar'] Mar 9, 2016 3:03:00 PM / by Allen Koroll posted in CRA

For several years, the Canada Revenue Agency (CRA) has been seeking to convince Canadian taxpayers of the benefits of filing their annual tax return online, and it seems that their efforts have been successful. Last year, over 80% of Canadian taxpayers filed their returns by electronic means. The change has been a rapid one, as nearly 40% of tax filers filed a paper return in 2011, with that number dropping to less than 20% in 2015.